Got a car to sell? Get a free valuation →

Car Leasing Eligibility – Can You Lease a Car?

We break down who can lease a car, what checks are involved, and what you’ll need to get started – whether you’re applying personally or through a business.

Car Leasing Eligibility – Can You Lease a Car?

If you’ve been eyeing up a shiny new lease car but wondering if you actually qualify, you’re not alone. Whether you’re leasing personally or through a business, there are a few things that finance providers look for before approving your application – but it’s not as scary as it sounds.

In this guide, we’ll walk you through who’s eligible to lease, what’s involved in the process, and what you’ll need to apply. Spoiler: it’s probably easier than you think.

Who can lease a car?

If you meet the basic criteria below, you’re likely eligible for a lease – either personally or through your business.

✅ Personal leasing (PCH):

To lease as an individual, you’ll need to:

Be at least 18 years old

Hold a full UK driving licence

Pass a credit check

Have a stable income or proof you can afford the monthly payments

You don’t have to own a house or be on a huge salary – leasing is accessible to lots of people, as long as you can show you’re financially responsible.

✅ Business leasing (BCH):

To lease through a business, you’ll need to be:

A limited company, sole trader, LLP, or partnership

Actively trading (usually for at least 3–6 months, longer is better)

Able to provide proof of income, bank statements, or filed accounts

Registered in the UK

Finance companies mainly want to see that your business is legit, has a financial history, and can afford the lease payments.

Do I need a good credit score to lease a car?

You don’t need perfect credit – but you do need decent credit.

Every lease application includes a credit check (for personal and business leases). This helps the finance provider make sure the agreement is affordable and that you’re likely to keep up with payments.

Here’s how it breaks down:

Good credit – you’re likely to be approved quickly with competitive terms

Fair credit – you might still be approved, but your options may be more limited

Poor credit – leasing may be tricky, but it’s still worth a chat with us. We can sometimes help find a suitable option

💡 Tip: If you’re worried about your score, use a free credit checker (like Experian or ClearScore) to see where you stand before applying.

What documents do I need to lease a car?

Not a massive list – but there are a few things you’ll need to provide:

For personal leasing:

Copy of your driving licence

Proof of address (like a recent utility bill or bank statement)

Possibly proof of income (especially if you're self-employed)

For business leasing:

Your company registration number (Companies House number)

Business bank details and recent statements

Director/partner info

Possibly filed accounts or proof of trading history

Once you’ve picked your car, we’ll let you know exactly what’s needed – and we’ll help you gather it if you need a hand.

Can someone else insure or drive the lease car?

Yes – as long as the person is:

Listed on the insurance policy

Approved by the insurer (e.g. has a valid licence, meets age requirements)

For personal leases, the leaseholder doesn’t always have to be the policyholder. As long as you're named on the policy, you're covered to drive. For business leases, insurance usually falls under a business or fleet policy, with named drivers added as needed.

Do I need a job to lease a car?

Generally, yes – but it doesn’t always mean a traditional 9–5. You just need to show that you can afford the monthly payments. That could be through:

A regular salary

Self-employment income

Pensions or long-term benefits (in some cases)

A guarantor or joint application (rare, but possible)

If you're unsure, chat to us. We can often find a solution if your circumstances are a bit outside the box.

Can I lease with bad credit?

It’s harder – but not impossible.

If you’ve had credit issues in the past, it may limit the finance options available, or you might be asked for a higher upfront payment. We’ll always be honest about what’s possible and help you find the best route forward if you’re not quite there yet.

The bottom line

If you’ve got a full licence, a steady income, and a reasonable credit score, you’re probably good to go. Leasing is designed to be flexible and accessible, whether you're driving for work, family life, or just want something new every few years.

Not sure if you’re eligible? Just get in touch – we’ll happily run through it with you, no pressure.

What's next?

Enjoyed this? Read our latest news

Huge New Grant Slashes Electric Car Prices by Up to £3,750

The UK’s latest £3,750 electric car grant is expected to drive lease prices down across popular EV models. Here’s how the new incentive could save you money on your next lease.

Hyggemarketing: Reliable Nationwide Travel for a Growing Agency

Jack Vernon, CEO of Hyggemarketing, shares how his VW Caddy lease from Motorlet transformed his travel experience—bringing comfort, professionalism, and room for his beloved Akita, Orla.

John Worth Group: A Seamless Fleet Leasing Experience with Motorlet

John Worth Group, a renowned interiors specialist, partnered with Motorlet to streamline their management vehicle fleet. Over two years, they've experienced professional service, timely deliveries, and competitive pricing, reinforcing their trust in Motorlet's leasing solutions.

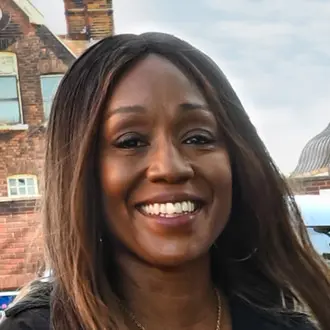

Customer Stories

We've helped over 1,000+ customers find their dream car, hear what they have to say.

Read more reviews“As usual, top class service. The team at Motorlet provided first class service from beginning to end with the friendly helpful expertise of Josh and Wendy. Will continue to use their services as I have done for the past six years...” Keep reading

Diane Parish | Audi Q5

New deals weekly

Subscribe to get the latest offers, guides, new, and more, straight to your inbox.