GAP Insurance

Learn more about Contract Hire or Lease GAP Insurance and why this could benefit you.

What is GAP Insurance?

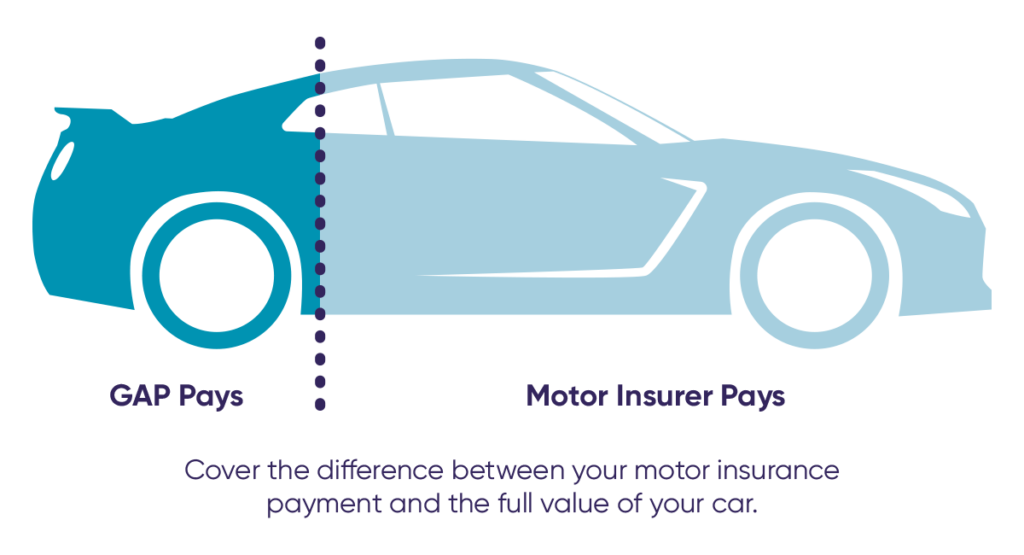

If your car is written off by an accident, fire, theft, or flood, your main insurance policy will pay out the market value of the vehicle at the time of the claim. This is great, but sometimes this amount is not enough to cover the settlement figure of your lease agreement, and you’ll have to pay the extra yourself. That’s where GAP Insurance comes in.

Contract Hire or Lease Guaranteed Asset Protection (GAP) Insurance will cover the extra cost between the current market value of your car and the settlement figure of your lease contract.

Learn more about Contract Hire or Lease Guaranteed Asset Protect (GAP) Insurance.

How does GAP Insurance work?

Let’s say you lease a Volkswagen Polo, worth £12,000, and you take it over a 2-year agreement. 18 months in, your car is written off. Your main insurer pays out the fair market value for the vehicle, which for this example is £8,000, but the lease company send you a settlement of £10,000.

This means there is an outstanding amount of £2,000, which you are liable for. GAP insurance will cover the difference between the market value your insurer pays out and the settlement figure, leaving you debt free!

What is covered by Contract Hire or Lease GAP Insurance?

If your vehicle is declared a total loss by your motor insurance company, GAP insurance will pay the difference between the amount settled by the insurer, and the amount required to settle your lease agreement.

Your GAP insurance includes:

Cover for the value of all factory fitted and dealer fitted accessories that were included in the initial invoice.

£250 towards your motor excess, in the event this can’t be recovered from a third party.

Cover for your initial rental or deposit, up to a maximum of £2,000.

100% cover of outstanding rentals.

You can also choose to transfer this cover to a family member or to a new policy where the vehicle is replaced under a comprehensive motor insurer policy.

What is not covered by GAP Insurance?

When you receive your policy, you’ll find there’s a limit to your GAP Insurance that caps the maximum you can claim for. This is something you’ll be able to discuss beforehand. It’s important to check that your model is not excluded from GAP Insurance – if you’re considering an Aston Martin or a Bentley, you won’t be able to get GAP for these manufacturers.

There’s a couple of other things that are not covered by your GAP Insurance:

Any non-standard extras that do not appear on the original invoice are not covered by GAP, such as added spoilers or body kits.

The road fund license, delivery charges, number plates, new vehicle registration fee, admin fees, paintwork and/or upholstery protection kits, cherished number plate transfers, insurance premiums, subscription charges, or warranty charges, are not covered by GAP.

You won’t be covered for any finance arrears and associated costs, any negative equity, or VAT (if you are VAT registered and able to reclaim that element).

Any excess over £250 will not be covered.

Any claim where the driver under the comprehensive insurance is deemed to be driving without a valid license, under the influence of alcohol or drugs, or has been disqualified from driving.

Any claim where you are entitled to or are offered a replacement vehicle by your comprehensive motor insurer.

How do I pay for my GAP Insurance?

You can purchase your GAP Insurance and pay the premium at the time you lease your vehicle. Payment can be made as a one-off payment to your motor retailer, or you can spread the cost across 10 interest-free monthly payments. You can even decide to add the premium to a loan agreement, but this might mean you’ll end up paying interest. All of these details will be explained by our team at the time of purchase – we’d be happy to help you out.

When does my GAP Insurance start and end?

Your Contract Hire or Lease Car GAP Insurance will run from the start date detailed on your policy.

The cover will end when:

There has been a claim paid out.

You cancel the policy.

The car has been sold, repossessed, or disposed of.

You have reached the end date specified on your policy.

It’s also important to note that this insurance cannot be renewed.

How do I cancel my GAP Insurance?

If you haven’t made a successful claim on your GAP Insurance policy within 30 days of receiving the policy documents, you can cancel your contract and receive a full refund. If you cancel after the 30 day period and have not made a claim, you’ll pay for the number of months you have had the contract and will be refunded the remainder, minus a £50 admin fee. No refund can be given if any claims have been paid.

What do I do now I’ve got my GAP Insurance?

You must always take care to supply the most accurate information about yourself, the vehicle, and any circumstances that may affect your policy. If you know that any information you have previously supplied has changed, you need to inform your GAP Insurance provider to keep your policy valid.

You must also insure your vehicle with a comprehensive motor policy.

FAQs

Can I take out GAP if I have already taken delivery?

Yes, but you must do it within 90 days of your delivery.

Do I need GAP insurance?

This really depends on two things; the terms of your finance agreement and what's included in your main insurance policy. The best thing to do is talk to your account manager and insurer. Although it's recommended to have GAP, it is completely optional.

Do you cover named drivers?

Yes, as long as they are insured by your main motor insurer to drive the vehicle.

Can I still put a private registration on my vehicle?

Yes, that is no problem at all. If you do this after taking the vehicle, you must let us know as soon as possible.

Is there an excess payable?

No, there is no excess payable on a GAP policy. In fact, it reimburses you £250 of your excess, should you need to pay it.

Is there a claim limit?

All policies are different and that will need to be a question you ask the sales advisor dealing with your policy. Or you can call us to ask, on 01223 661800.

Can I transfer my policy to another vehicle?

Yes, you can. Just speak to your account manager and this can be arranged.

What's next?

Enjoyed this? Read our latest news

EV Myths Debunked

In this guide, we debunk the biggest EV myths so you can get the real facts and decide if an electric car is right for you!

Should You Lease or Buy an Electric Car?

This comprehensive guide breaks down the financial implications of both options, helping you understand which approach makes the most sense for your situation.

Are Electric Cars Cheaper to Lease?

Considering an electric vehicle but unsure about leasing versus buying? Our Electric Leasing Guides break down everything you need to know about EV financing options.

Customer Stories

We've helped over 1,000+ customers find their dream car, hear what they have to say.

Read more reviews“As usual, top class service. The team at Motorlet provided first class service from beginning to end with the friendly helpful expertise of Josh and Wendy. Will continue to use their services as I have done for the past six years...” Keep reading

Diane Parish | Audi Q5

New deals weekly

Subscribe to get the latest offers, guides, new, and more, straight to your inbox.